Home Improvement Protection

The 3 Most Important Things You Need to Know to Legally Protect Yourself,

Why You Never Hear About Them, And The Consequences of Ignoring Them.

Item 1. Wisconsin Home Improvement Trade Practices Code: ATCP – 110

Established in 1974, the Wisconsin Home Improvement Trade Practices Code, sets the laws which govern home improvement transactions and contracts as well as provide guidelines for remedying contractor disputes and improprieties.

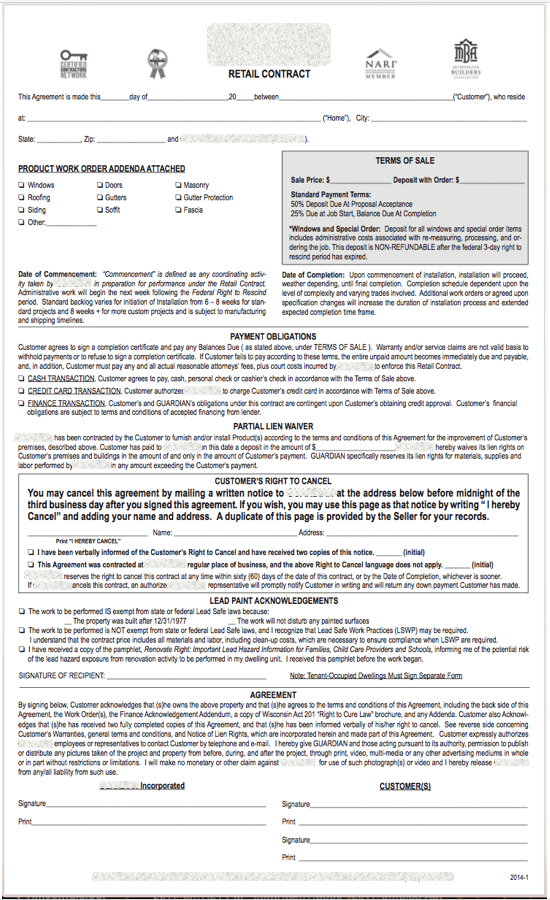

The code outlines specific details and components that are required to be in a construction contract in order for the contract to be considered valid to protect the homeowner and provide a firm legal basis for reclaiming any damages if the agreed upon contract is not fulfilled.

By signing a contract that does not meet the code, contract requirements, or proper disclosures homeowners are unknowingly, voluntarily giving up their rights.

If you would like to see the full documentation, click here.

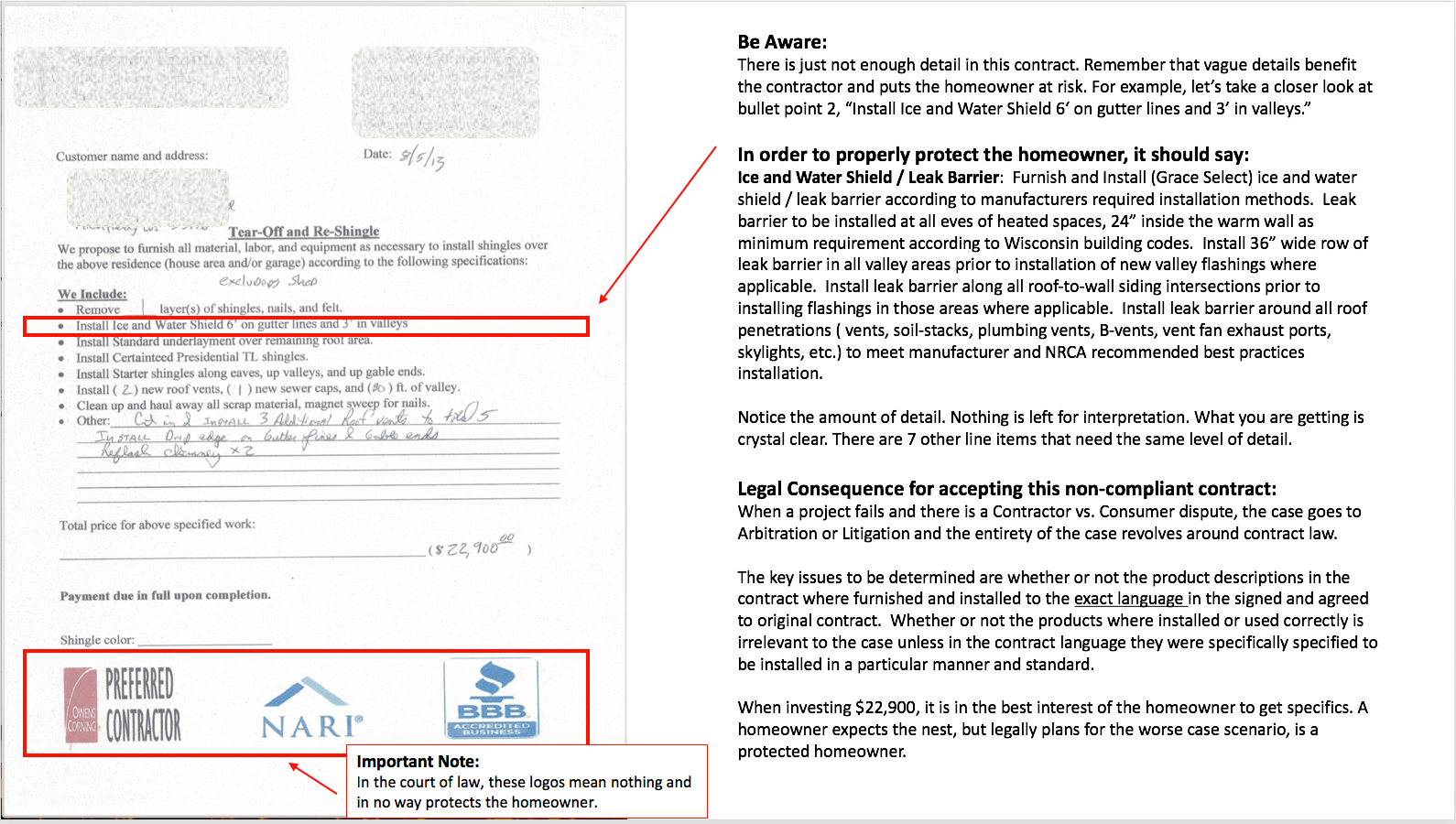

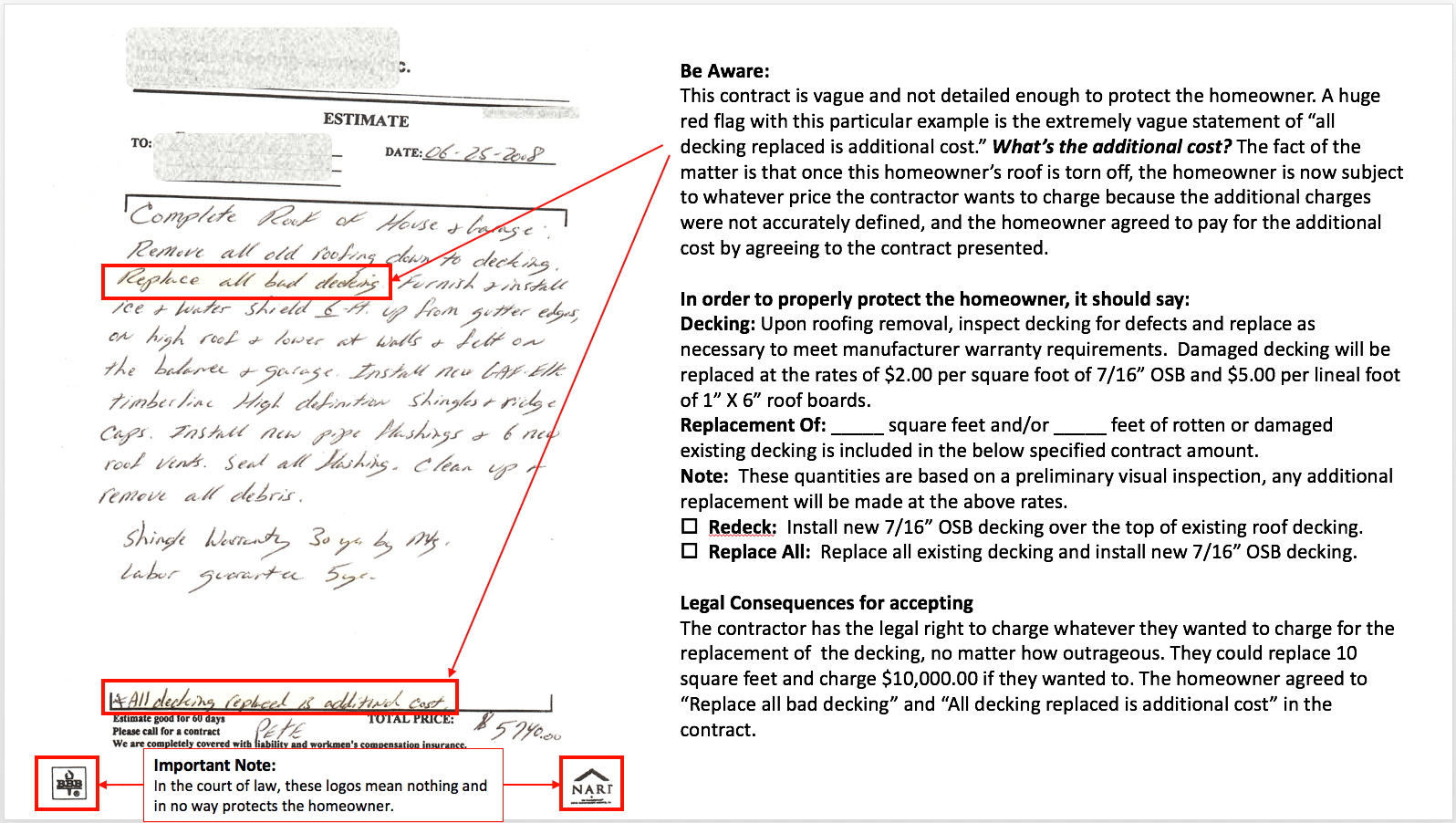

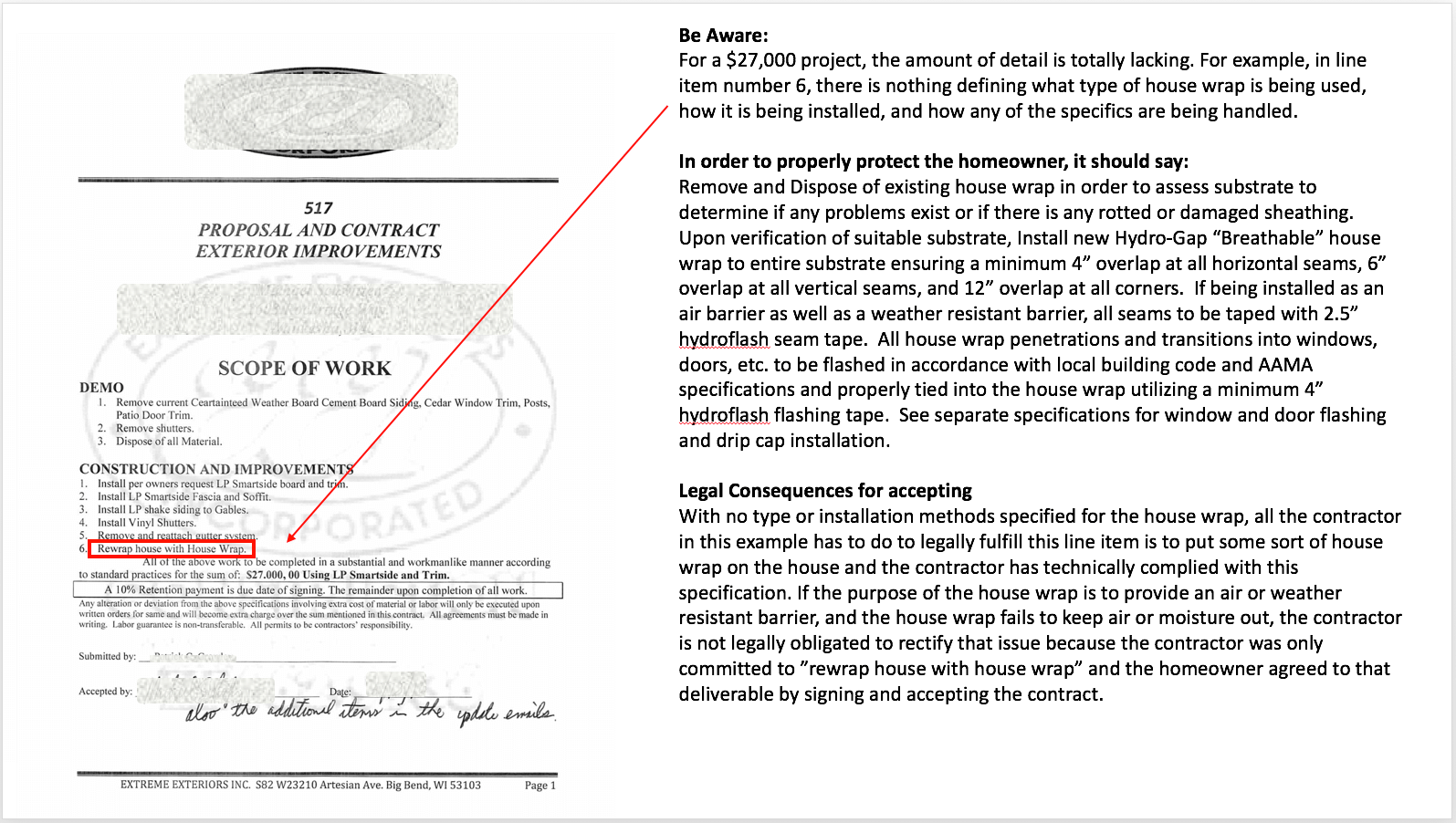

The most important thing to know about this Code and how to use it to protect yourself is that the details in your construction contract is critical. The more detailed the specifications are on the contract regarding your project, the better protected you will be, in case something happens and you need to pursue legal action.

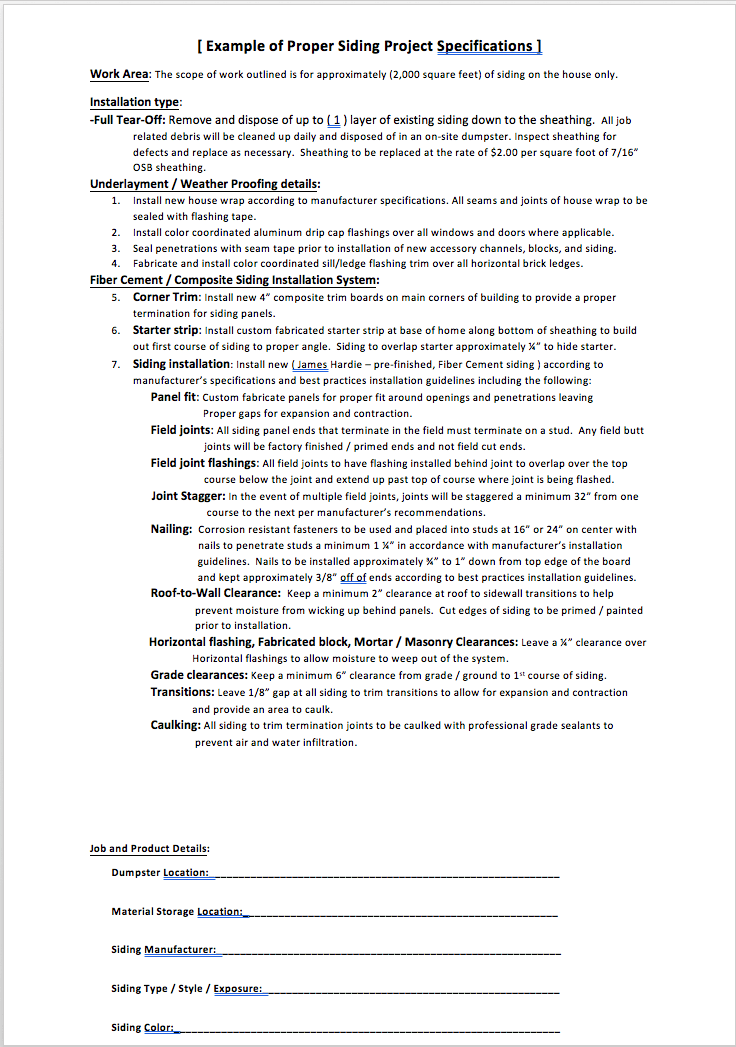

Here are ATCP-110 COMPLIANT elements:

Don’t make the mistake of simply assuming that the contract that you are signing has been written to protect your interest. Exact and detailed information protect you, while vague and unspecific language benefits the contractor.:

Why do contractors circumvent this code?

Contractors know that there is no enforcement of ATCP-110, and that it is up to the consumer to determine what they will or will not accept from a contractor agreement. Because these contractors know that most homeowners are unaware of what they should be looking for, they know that they can get away with getting people to sign a contract that has them giving up their rights.

Not complying with ATCP-110 is extremely beneficial for contractors because it allows the contractor to remain very vague with what they are contractually doing and pushes much of the legal and financial risk burdens of performing home improvements off of the contractor and all on to the consumers.

What are the consequences to the homeowner?

This can leave homeowners with an incomplete job, a faulty installation, a completed project that did not fix their problem, or even worse damages than before the work was done. And because of signing a contract that did not comply with ATCP-110, they have a very minimal chance of getting any of their money back or any work redone.

What do homeowners need to do to protect themselves?

See more examples of correct and incorrect contracts.

If the dollar figures involved with the project are significant, it would be in your best interest to have a construction lawyer look over the contract.

Item 2. State of Wisconsin’s Right to Cure Law (Dispute Resolution Process)

Click here to view the PDF document.

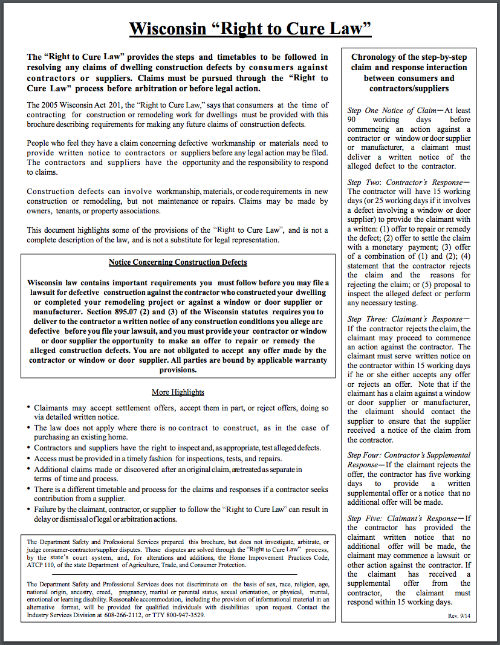

What homeowners need to know is that this document outlines the specific steps that need to be followed by BOTH consumers and contractors in the event of a dispute. Failure by the homeowner [claimant], contractor, or supplier to follow the “Right to Cure Law” can result in delay or dismissal of legal or arbitration actions.

Why do contractors circumvent this code?

When a dispute arises, it is beneficial to the contractor to follow the Right to Cure dispute resolution process and have the homeowner, unknowingly, not follow the process. The Right to Cure law clearly states that failure by any party, including the unaware homeowner, to follow the Right to Cure law can result in delay or dismissal of legal or arbitration actions.

Even though the contractor may be 100% wrong, did terrible work, did not fulfill the contracts, or just flat out lied, these cases are often thrown out of court without being heard because the contractor attempted to follow the “Right to Cure” process, and the homeowners did not. It doesn’t matter that the homeowner did not know the Right to Cure even existed or what they were supposed to do in order to comply.

What are the consequences to the homeowner?

What do homeowners need to do to protect themselves?

“The 2005 Wisconsin Act 201, the “Right to Cure Law,” says that consumers at the time of contracting for construction or remodeling work for dwellings must be provided with this brochure describing requirements for making any future claims of construction defects.”

–Wisconsin “Right to Cure Law”

If you are not presented with the Right to Cure Law brochure with your contract, that should be a major red flag because that particular contractor is in violation of the 2005 Wisconsin Act 201, the “Right to Cure Law.”

Item 3. The 4 Construction Risk Insurance Policies

The standard advice given to homeowners looking for a contractor is to make sure that the contractor hired is “licensed and insured.” The following explains the 4 different insurances that are applicable to home improvement, their definitions, and why they are important.

The 4 types of applicable Construction Risk Insurance policies in Wisconsin are:

- Worker’s Compensation

- General Liability

- Products and Completed Operations

- Errors and Omissions

Here are the definitions of each policy:

Worker’s Compensation:

Worker’s Compensation Insurance covers any accidents or injury incurred by any employee of a business operating in the state of Wisconsin. Worker’s Compensation Insurance policies are required for any business that operates with employees in the state of Wisconsin. Worker’s compensation insurance policies protects you against any lawsuits and liabilities of worker related injuries while your project is being constructed.

Office: 262-673-0000 | Email: [email protected]

General Liability:

General Liability Insurance policies insures against any accidents that could occur while your project is under construction or any damage caused to your home or a neighbor’s home or property while project is being completed. It does not provide any coverage after the project is complete.

Office: 262-673-0000 | Email: [email protected]

Products and Completed Operations:

Products and Completed Operations policy Insures against losses arising out of the services performed by building contractors AFTER the project is completed. It is an insurance policy covering that your project was properly installed as Specified for Work Completed against future workmanship related defects. The Products coverage component covers any supplied manufacturer’s products used in the project that do not perform to the stated manufacturer product specifications. This insurance policy protects You in the Future after your job is completed and is many times the only way to recover losses in the future if a problem or defect develops.

Disclaimer –

Warning, many construction insurance policies have exclusions in the policy for claims against Workmanship or Craftsmanship. These exclusions can severely limit your protection and ability to make a future claim for workmanship related defects or to force a contractor to honor any type of warranty or guarantee.

Solution –

You must call and talk to the insurance agent listed on the policy to confirm that the contractor’s Insurance Certificate covers workmanship and craftsmanship. Make sure it does not have any exclusions that limit the coverage or increase Your risk of paying out-of-pocket for future construction defects.

Office: 262-673-0000 | Email: [email protected]

Errors & Omissions:

Errors and Omissions, also known as Professional Liability Insurance, insures against claims arising from a failure to render professional services. For construction projects, it Insures proper specifications were designed.

Office: 262-673-0000 | Email: [email protected]

Why do contractors circumvent this code?

Contractors operate without Worker’s Compensation policies to avoid the expense, and therefore make more money. It is illegal for any business in Wisconsin to operate without this insurance policy in place if they have any employees. Contractor’s can be fined by the State if caught but there is no pro-active enforcement mechanism in place to police compliance.

General Liability Insurance policy

Contractors do not carry General Liability Insurance policies to avoid the expense to once again make more money. There is no risk or penalty to contractors for not carrying the policy.

Properly licensed Contractors in Wisconsin are required to maintain a current: General Building Contractor Certification and Financial Responsibility Certification.

These certifications require contractors to document a minimum $250,000 of liability insurance coverage or post a $25,000 bond.

The only enforcement mechanism is that if a permit is pulled by the contractor, municipalities are required to have the contractor provide their General Building Contractor Certification License number to complete the permit application.

There is no pro-active enforcement mechanism in place to police compliance.

Products & Completed Operations policy

Products and Completed Operations insurance is voluntary in Wisconsin and not required to be in place as a condition of contractor licensing.

Errors & Omissions policy

Errors & Omissions insurance is voluntary in Wisconsin and not required to be in place as a condition of contractor licensing.

What are the consequences to the homeowner?

If you hire a contractor that does not have proper Worker’s Compensation Insurance in place, you are considered the General Contractor and take on ALL liabilities and worker related project Risks!

[provide link to proof]

General Liability Insurance policy

If there is no General Liability policy in place, YOU are considered the general contractor and take on all the construction liabilities and project risks! If the contractor you hire is ‘under insured,’ potential risks and liabilities could exceed the insurance coverage and you would be responsible for any short falls out-of-pocket.

Make sure any contractor you are considering is covered for enough General Liability to cover you and your home. For you to be fully covered, the policy must exceed the value of your home and belongings and also have excess above and beyond that amount to cover any incidentals if there was a catastrophic accident.

The owner may be held liable for any bodily injury or death of others or for any damage to the property of others that arises out of the work performed that is caused by any negligence by the contractor that occurs.

The owner may not be able to collect from the contractor damages for any loss sustained by the owner because of a violation by the contractor of the One- and Two-Family Dwelling Code or an ordinance enacted under sub.(1)(a), because of any bodily injury to, or death of, others or damage to the property of others that arises out of the work performed or because of any bodily injury to, or death of, others or damage to the property of others that is caused by any negligence by the contractor that occurs in connection with the work performed.

Products & Completed Operations policy

If a Products and Completed Operations Policy is not in place, you will likely have no recourse for improperly installed projects and have no way to enforce any Product Warranties or Contractor Workmanship guarantees.

Errors & Omissions policy

If the contractor hired does not have an Errors & Omissions policy in place, there is no legal recourse for incorrectly specified projects that fail pre-maturely.

What do homeowners need to do to protect themselves?

Next, Wisconsin [ATCP 110.05 (4)] requires that any contractor that claims to have insurance and is selling you products or services at your home, be able to show you a copy that includes all information including the insurance agent’s contact information, so you can call to verify the insurance is valid prior to signing a contract.

You need to call the insurance company and verify the validity of all insurance policies that are presented to you. It is a mistake to simply take the contractor’s word for it.