Payment Options

As seen in the Milwaukee Area

Smart Way to Pay Options

GUARDIAN’s Impeccable Reputation has allowed us to form strategic partnerships with several Trusted financial institutions to provide direct & personalized access to a variety of payment and finance options.

Financing

Home Improvement Financing to Fit Your Needs

- Credit limits up to $55,000

- Fast approvals

- Friendly customer service

- Multiple ways to make a payment

- No prepayment penalties

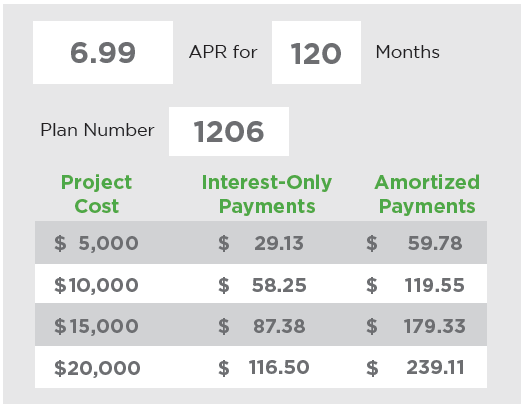

Pick the Plan That is Right for You

Option 1

Option 2

We are pleased to offer the following additional in-house payment & finance options to choose from:

GUARDIAN’s Impeccable Reputation has allowed us to form strategic partnerships with several Trusted financial institutions to provide direct & personalized access to a variety of payment and finance options.

Unsecured Loans

In some cases, homeowners want to finance their project without securing the financing with a second mortgage. They just want convenient and easy payment terms with flexible payment options.

- No money down, No payments, No interest – Same-as-Cash options for 12 months

- Same-as-Cash convertible to 10 year installment loans options

- No interest, payment only options up to 84 months

- No money down, reduced interest, low monthly payment options up to 10 years

- Options available from marginal to well-qualified credit ranges

- From $1,000 to $45,000… on approved credit

- No appraisals

- Easy 10 minute approval process

Home Improvement Installment Loans

- No payments and deferred interest… same as cash options available on approved credit starting after the date of installation

- No prepayment penalties… great for those who want to pay cash when the job is complete or within 90 days

- From $1,000 to $45,000… on approved credit

- No appraisals

- Quick and easy… loan-by-phone application process

- Decisions… in about 10 minutes

Revolving Line of Credit

- Revolving credit line financing… open line of credit for all your purchasing needs

- Loans range from $1,000 to $20,000… on approved credit

- Fast and simple application process.

- Convenient monthly payments… no annual fee and no prepayment penalties

- Easy add-on purchasing

- Deferred interest promotional offers

- Low monthly payment options

- Reduced consumer APR with fixed monthly payments

- Easy-to-use online bill payment option

We are pleased to offer the following additional in-house payment & finance options to choose from:

Mortgage Refinancing:

When interest rates are low, refinancing your primary home loan can significantly lower your monthly payment, making room in your budget for a home improvement loan. Our Certified Mortgage Planner can work with you to help determine and customize the best option your the most comfortable with. Options including:

2nd Or 3rd Mortgages:

Borrow the money you need using your home’s equity as collateral. Also called a “home equity loan” or “home improvement loan”.

- Long term home improvement loans with up to 30 year repayment terms for larger projects

- Tax deductible interest (check with your tax advisor)

- Rates are based on the customer’s credit score and home equity

- These loans are generally secured by a Deed of Trust on the home, which can give you a lower interest rate and a longer time period to repay

Loan Consolidation:

You can often free up monthly cash by consolidating your credit card bills, car loan and other debts into a single, lower-interest loan.Guardian Also Accepts All Major Credit Cards ( Visa, Mastercard, Discover, American Express ) as well as Cash, personal check, certified funds